Written By: Avik Ghosh & Suman Saurav – Managers of RBI

Credit Growth and NPA

Rejuvenate credit growth by waning NPA menace

Having the tag of one of the key emerging economies with comparably high growth projection, India needs to have its growth drivers in place to maintain all-encompassing economic sustainability. When we are using the term growth drivers, we talk about the multiplicative effect of investment and savings on productive gross capital formation resulting in more value addition in the economy as a whole.

Taking reference from the relationship of regenerative output and capital, as formalized in Cobb Douglas equation of macroeconomics, it is evident that the availability of sustainable capital changes the future growth in positive direction resulting in the addition of more productive assets and generation of more employment. This availability of capital, especially through the formal banking channel, is highly impacted by the savings and investment pattern in the economy and the health of the banking sector to disburse credit in line with the need of the economy.

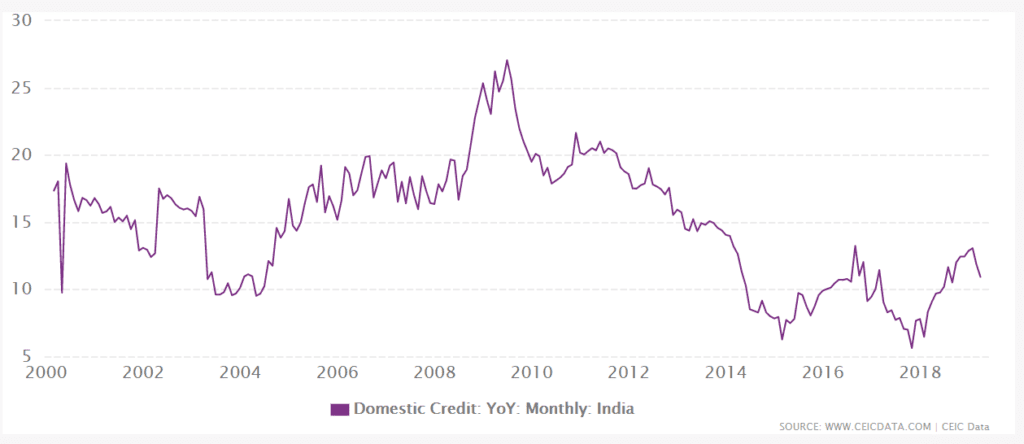

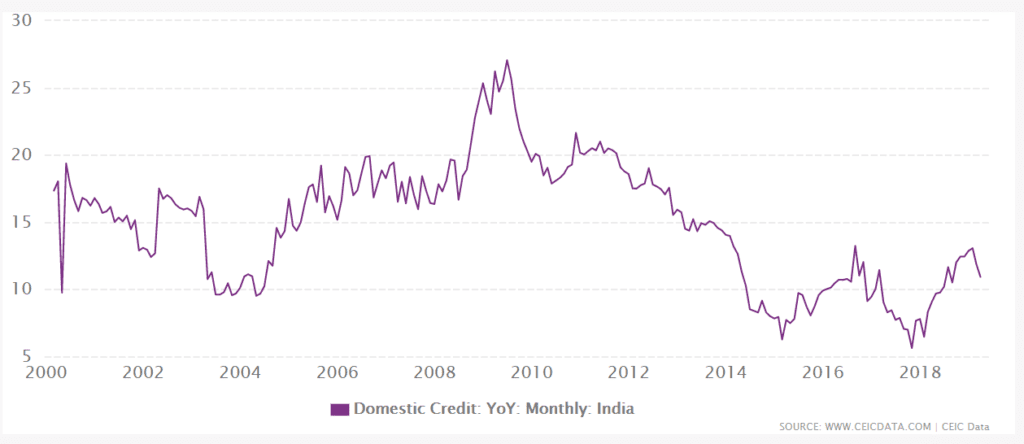

When we analyze the credit growth pattern of India since 2000, it reflects many insights regarding the pattern of credit disbursal by banks and its subsequent effects on future credit. The credit growth pattern emulates a typical

‘head and shoulder’ pattern with a consistently high growth period from 2005 to 2012 where an average 17% domestic credit growth rate was observed. This was followed by a slump for five consecutive years where the credit

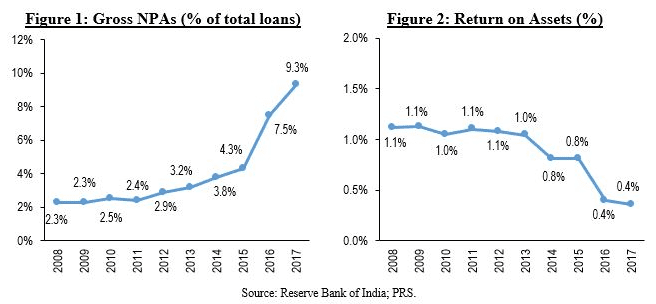

growth touched as low as 5.8%. This can be singled out as a clear effect of rising NPA and various resolution measures of RBI namely structural debt restructuring (SDR), corporate debt restructuring (CDR) and sustainable structuring of stressed assets (S4A). The Reserve Bank set up a Central Repository of Information on Large Credits (CRILC) in 2014 which was followed by an Asset Quality Review (AQR) in 2015. As a result of these initiatives, the recognition of non-performing assets improved, leading to a sharp rise in the gross NPA ratio from 4.3 per cent at end-March 2015 to 7.5 percent at end-March 2016. It further reached the peak of 11.5 percent in March 2018.

It is assessed further from the credit growth pattern graph that the typical ‘head and shoulder’ pattern is again leaping forward for another ‘head’, though with a lesser peak amplitude. This expected stability is potentially the outcome of various supervisory measures and regulatory frameworks put to practice by the Reserve Bank of India. Recent supervisory data suggests that various efforts made by the Reserve Bank in strengthening its regulatory and supervisory framework and the resolution mechanism instituted through Insolvency and Bankruptcy Code (IBC) are bearing fruit. This is reflected in significant improvement in asset quality of scheduled commercial banks (SCBs) during 2018-19 as gross NPA ratio declined to 9.3 percent as on March 2019.

This reduction in NPA is not only catapulting credit growth but also bringing the confidence bank amongst the lenders. The formation of a majority government ushers stability whereas the improvement in NPA trend and supervisory prodding for effective internal control in banks are helpful to have an efficiently controlled credit culture. The latest changes in NPA resolution norms by RBI on June 7, 2019 talk about an extended 30 days resolution leverage, reporting credit information of all borrowers having aggregate exposure of ₹5 crores or more, imposing inter-creditor agreement in case of resolution, weekly report of default to RBI will not only strengthen the supervisory control but will eventually lead to better operational return for lenders.

The information asymmetry on domestic credit has long been an area of concern. The Central Repository of Information on Large Credits (CRILC) database contains information from all SCBs (excluding RRBs) on all credit instruments for borrowers having aggregate exposure of INR 50 million and above capturing about 60 per cent of the entire bank credit and around 80 per cent of the non-performing loans of SCBs by value but its coverage is miniscule in terms of number of accounts.

Reserve Bank of India constituted a High-Level Task Force (HTF) under the chairmanship of Shri Y. M. Deosthalee to form Public Credit Registry (PCR) with an aim to prepare an extensive database of credit information for India that is accessible to all stakeholders for enhancing efficiency of the credit market. This move may turn out to be a game changer in overall credit culture by increasing financial inclusion and controlling delinquencies.

For a key emerging economy like India where more employment generation is the need of the hour and improved industrial capacity utilization is a must, it cannot afford to allow to slow down credit growth. The newer supervisory norms, stricter internal control, more credible information symmetry are essentially migrating the bank lending towards an efficient and organized credit culture. This culture will not only compliment the growth trajectory of India but also ensure its much-needed sustainability.

Views expressed in the article are personal and not of RBI.