Bharat Coking Coal IPO opens with a strong response

The Bharat Coking Coal IPO opened for subscription today and was fully subscribed shortly after launch, reflecting strong investor demand. As the first major public offering of the year, it is attracting keen interest from both retail and institutional investors, supported by strong parentage and scarce coking coal reserves.

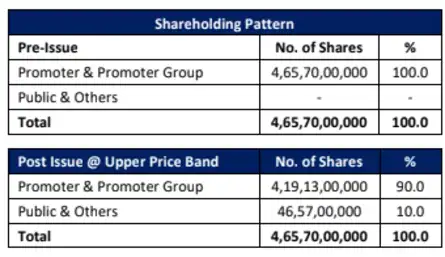

Bharat Coking Coal, with a strong market share in the industry valued at ~8.64x P/E on FY25 earnings (at the upper band) is valued fairly. Considering the company’s consistent track record & superior financial metrics, the valuation is fully priced in. Hence, we recommend subscribing to the IPO for listing gains.

– Anand Rathi Share and Stock Brokers Ltd.

Bharat Coking Coal’s IPO comes at a time when investor preference has tilted toward businesses with stable cash flows and clear visibility on demand. As a public sector enterprise operating in a core segment of the domestic energy value chain, the company benefits from predictable offtake and a well-established operating framework. The pricing appears to offer reasonable valuation comfort relative to its earnings profile, which has traditionally been a key factor driving retail participation in PSU offerings. With the issue opening today, investors looking at this IPO are essentially evaluating valuation support and earnings visibility rather than aggressive growth. While the coal sector remains cyclical and subject to regulatory oversight and cost pressures, such risks are relatively well understood and largely priced in. From an investment perspective, this IPO may be more suitable for investors seeking near-term listing performance or stability-driven exposure, rather than those looking for long-term, high-growth opportunities.

– Prasenjit Paul, Equity Research Analyst & Fund Manager of 129 Wealth Fund

Bharat Coking Coal IPO Day 1 Live Updates: Issue gets over 2.29 times subscription

Employee Reserve: 0.30 times

Retail Individual Investors (RIIs): 3.15 times

Non-Institutional Investors (NIIS): 3.60 times

Qualified Institutional Buyers (QIBs): 0.01 times

The BCCL IPO is much more than a routine listing, it is a clear strategy to unlock embedded value. You are looking at immediate cash inflows, a meaningful rerating potential for the parent, and a strong growth runway at the subsidiary level. More importantly, it sets a template that can be replicated across multiple businesses. For Coal India shareholders, this could mark the start of a sustained, long-term value creation cycle and could realistically generate over 1 lakh crore in incremental shareholder value by FY2030.

– Gaurav Garg, Research Analyst at Lemonn Markets Desk

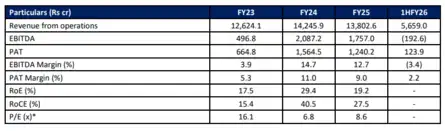

Bharat Coking Coal IPO Day 1 Live Updates: GMP rises to 43.5%

Bharat Coking Coal IPO Day 1 Live Updates: Key dates

Anchor bidding: Opens on January 8, 2026

Public issue: Open from January 9 to 13, 2026

Basis of allotment: On or around January 14

Refunds and unblocking of ASBA funds: From January 15

Listing date: Tentatively January 16

Bharat Coking Coal IPO Day 1 Live Updates: Strong Parentage

Bharat Coking Coal IPO Day 1 Live Updates: BCCL issue gets fully subscribed within half an hour on strong NII demand

Total: 1.04 times

Reservation Portion Shareholder: 1.17 times

Employee Reserve: 0.09 times

Retail Individual Investors (RIIs): 1.37 times

Non-Institutional Investors (NIIS): 1.88 times

Qualified Institutional Buyers (QIBs): 0.01 times

Bharat Coking Coal IPO Day 1 Live Updates: India’s largest Coking Coal producer

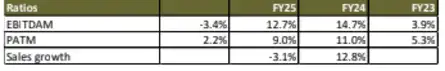

Bharat Coking Coal IPO Subscription Status Live: Key financials

Bharat Coking Coal IPO GMP Live Updates: BCCL IPO day 1 bidding starts

Bharat Coking Coal IPO GMP Live Updates: Risk factors

Bharat Coking Coal IPO GMP Live Updates: BCCL growth strategies

- Utilise resources effectively to sustain and expand operations.

- Transform discontinued mines into profitable ventures through resource monetisation and strategic repurposing.

- Monetise, modernise and renovate washeries.

- Explore opportunities in coal-bed methane projects to harness untapped energy resources.

BCCL is India’s largest producer of coking coal, accounting for 58.5% of domestic output in FY25. With estimated reserves of 7.91 billion tonnes and 34 operational mines, it ranks among the country’s largest coking coal reserve holders. The company posted revenue, EBITDA and PAT CAGRs of 4.6%, 88.1% and 36.6%, respectively, during FY23–FY25. Going forward, BCCL plans to expand washery capacity to 20.65 MTPA from 13.65 MTPA by setting up new washeries and upgrading the Moonidih washery, doubling its capacity to 1.6 MTPA. At the upper price band of Rs 23, the issue is valued at an EV/EBITDA multiple of 6.4x on a post-issue basis. We recommend investors subscribe at the cut-off price.

– SBI Securities on BCCL IPO

Bharat Coking Coal IPO GMP Live Updates: Expected Premium/GMP trend

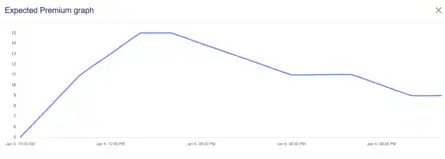

Bharat Coking Coal IPO Subscription Status Live: Shareholding pattern

Bharat Coking Coal IPO Subscription Status Live: Issue BRLM and Registrar

Bharat Coking Coal IPO Day 1 Live Updates: Bharat Coking Coal presence

Bharat Coking Coal IPO GMP Day 1 Live Updates: About the company

Bharat Coking Coal IPO GMP Live Updates: MF participation

Bharat Coking Coal IPO Subscription Status Live: Anchor investors

Bharat Coking Coal IPO GMP Live Updates: Bidding dates

- Anchor bidding: Opens on January 8, 2026

- Public issue: Open from January 9 to 13, 2026

Bharat Coking Coal IPO Subscription Status Live: Eligibility under shareholder quota

- Investors holding shares of Coal India Limited as of the record date, January 1, 2026, are eligible to apply under the shareholder quota in the BCCL IPO.

- This provision enables existing shareholders of the parent company to participate in the offering under a separate category.

- As the IPO opens in a few days, all eyes are now on the subscription numbers and final listing performance, especially in light of the strong premium being seen in the grey market.

Bharat Coking Coal IPO GMP Day 1 Live Updates: 5 reasons why SBI Securities says subscribe to Bharat Coking Coal IPO

Bharat Coking Coal IPO GMP Day 1 Live Updates: GMP

Bharat Coking Coal IPO GMP Live Updates: Is Bharat Coking Coal IPO worth buying? Expert Reviews

Anand Rathi Research has recommended a “Subscribe” rating in its IPO note, primarily for listing gains, citing the company’s dominant market position, strong reserve base, and strategic relevance to India’s steel industry. The brokerage noted that while the valuation appears fair at the upper price band, most positives are already priced in, limiting long-term re-rating potential.