In a 6-Point Note, FM Cleared Confusion Regarding The New Tax Regime

By: Geetanjali

Union Budget 2024, new tax regime will come in effect from Monday, April 1, 2024. People are getting confused due to the misleading information being spread across certain social media platforms.

Finance Minister, Nirmala Sitharamana taking it to the social networking site X, posted to clear misinformation regarding the new tax regime in a 6 point note.

It has come to notice that misleading information related to new tax regime is being spread on some social media platforms. It is therefore clarified that:

👉 There is no new change which is coming in from 01.04.2024.

👉 The new tax regime under section 115BAC(1A) was… pic.twitter.com/DtKGkK0D5H

— Ministry of Finance (@FinMinIndia) March 31, 2024

The post points at the below-mentioned 6 points:

- There will be no new change in the tax regime commencing from April 1, 2024.

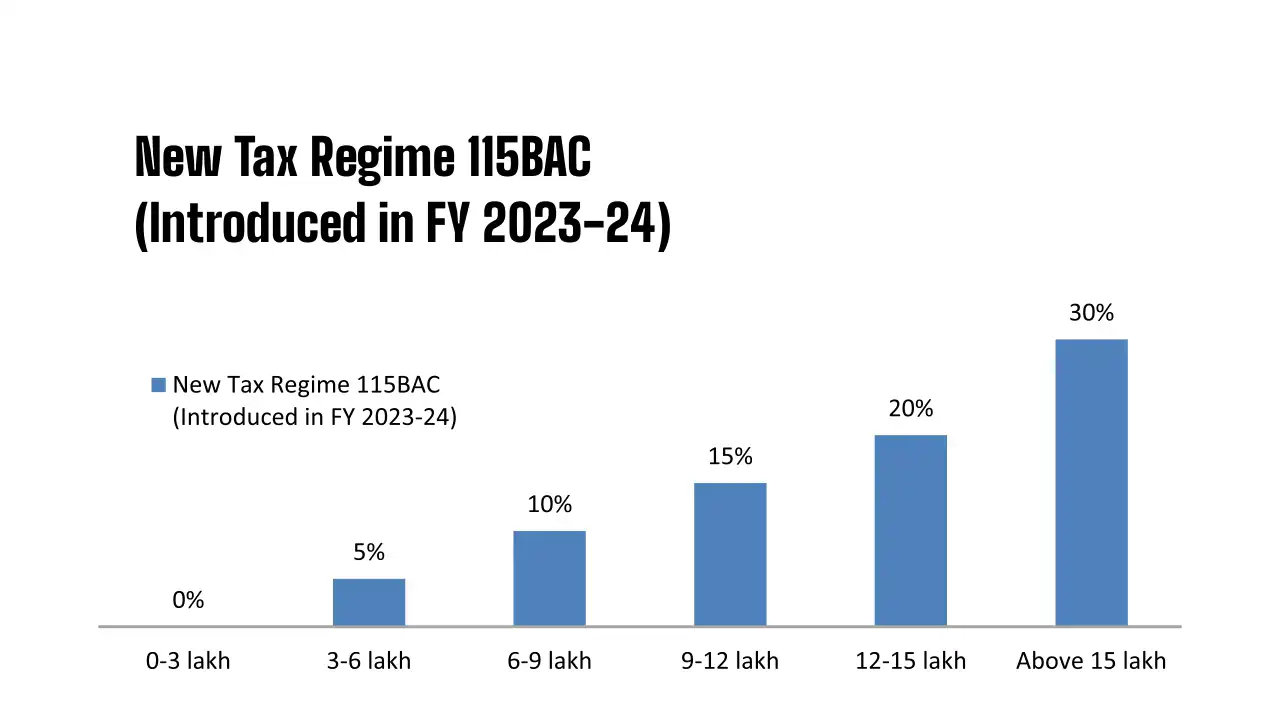

- New tax regime introduced in 2023 under Section 115BAC (1A) of the Finance Act 2023, as compared to the existing old regime (without exemptions)

- New tax regime is applicable for persons other than companies and firms, is applicable as a default regime from the Financial Year 2023-24 and the Assessment Year corresponding to this is AY 2024-25.

- Under the new tax regime, the tax rates are significantly lower, though the benefit of various exemptions and deductions (other than standard deduction of Rs. 50,000 from salary and Rs. 15,000 from family pension) is not available, as in the old regime.

- New tax regime is the default tax regime, however, tax payers can choose the tax regime (old or new) that they think is beneficial to them.

- Option for opting out from the new tax regime is available till filing of return for the AY 2024-25. Eligible persons without any business income will have the option to choose the regime for each financial year. So, they can choose new tax regime in one financial year and old tax regime in another year and vice versa

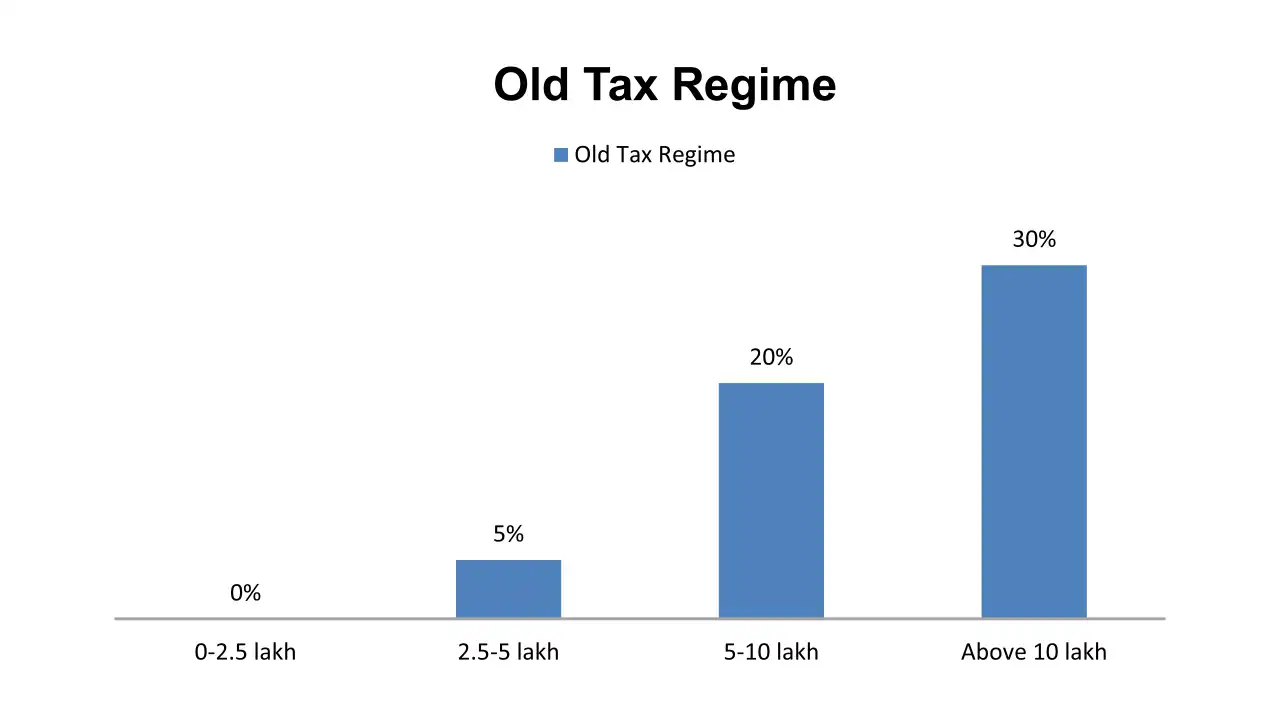

| New Tax Regime 115BAC (Introduced in FY 2023-24) | Old Tax Regime | ||

| 0-3 lakh | 0% | 0-2.5 lakh | 0% |

| 3-6 lakh | 5% | 2.5-5 lakh | 5% |

| 6-9 lakh | 10% | 5-10 lakh | 20% |

| 9-12 lakh | 15% | Above 10 lakh | 30% |

| 12-15 lakh | 20% | ||

| Above 15 lakh | 30% | ||

Add Business Connect magazine to your Google News feed

Read Also:

- Best business magazine in India

- Top 10 Most Inspiring Young Indian Entrepreneurs To Look Out in 2024

- Top 10 Technology Magazines

- Top 10 Competitive Exam Preparation Magazines in India

- Top 10 Entertainment Magazines Available in India

- The CEO Magazine Australia & Business Connect Magazine India

- 10 Benefits of Magazine Advertising for Businesses

- India’s Top 10 Business Magazines for 2024