Following a 2.7X oversubscription of its initial public offering, logistics and delivery giant ShadowFaxShadowFax Datalabs_in-article-icon is scheduled to list on the stock exchanges tomorrow. By selling off a portion of their interests during the IPO, the company’s early investors have recorded significant returns on their investments.

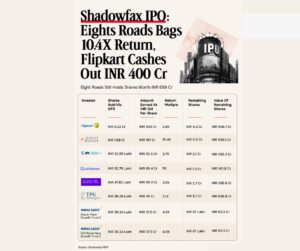

The company that benefited most from the public offering was Fidelity-backed Eights Roads Investments. By selling 1.58 Cr shares at the top of the price range of INR 124 per share, the company made INR 197 Cr. This resulted in a 10.4X return on the original investment. Following the deal, the venture capital firm now holds 5.5 Cr shares in Shadowfax at a price of INR 124 each, valued at INR 689.1 Cr.

A new issuance of INR 1,000 Cr and an offer-for-sale (OFS) component of up to 7.32 Cr shares totaling more than INR 900 Cr made up Shadowfax’s first public offering (IPO). For the public offering, the company announced a price range of INR 118–124 per share, with the upper end of the range valued at approximately INR 7,169 Cr (around $781.6 Mn).

One of Shadowfax’s first strategic investors, e-commerce giant Flipkart, made INR 400 Cr by selling 3.22 Cr shares through the OFS. Flipkart currently owns 4.2 Cr of Shadowfax shares, valued at INR 528.7 Cr.

The World Bank Group’s International Finance Corporation sold 52.86 lakh shares valued at INR 65 Cr, earning a 3.7X return on its initial investment. The institutional investor owns 2.1 Cr of the company’s shares, valued at INR 262.2 Cr.

Qualcomm Asia Pacific, based in Singapore, sold 52.75 lakh shares valued at INR 65.4 crore, earning a 5X return on its investment.

Mirae Asset Global sold 60.48 lakh shares in two distinct funds, Naver New Growth Fund I and GS Retail New Growth Fund I, for a total of INR 75 Cr. Using both funds, the global asset management achieved a 4.9X return on sale. Mirae Asset has 1.3 Cr Shadowfax shares, valued at INR 166.6 Cr, distributed nearly evenly between the two funds.

While Singapore-based venture investment firm NewQuest Asia sold 36.29 lakh shares valued at INR 45 Cr, held through its Fund IV, for a 2.1X return, B2B-focused VC firm Nokia Growth Partners reported a 3.5X gain on its investment by selling 47.82 lakh shares.

Shadowfax, a logistics platform for last-mile and hyperlocal deliveries, was established in 2015 and serves rapid commerce, restaurant delivery, and e-commerce businesses in India.

Shadowfax reported a 68% increase in operational revenue to INR 1,805 Cr in the first half of FY26 compared to INR 1,072 Cr in the same period the previous year. From INR 9.8 Cr in H1 FY25 to INR 21 Cr, net profit increased 114%.

Amidst the continuing startup IPO boom, Shadowfax will be the second modern tech company to go public in 2026, after Amagi.