The Supreme Court ruled on Monday that any assistance to the financially troubled telecom operator was within the purview of government policy, allowing the Center to reevaluate Vodafone Idea’s (Vi) adjusted gross revenue (AGR) obligations. The government’s argument that the action was motivated by consumer interest and the Center’s significant stake in India’s third-largest telecom operator was allowed by a bench made up of Chief Justice of India B R Gavai, Justices K Vinod Chandran, and Vipul M. Pancholi.

Speaking on behalf of the government, Solicitor General Tushar Mehta informed the court that the Center now owns 49% of Vi. He said that worries over the company’s enormous customer base had motivated the assessment. According to figures issued on Monday by the Trai, Vi has 202.8 million users as of September 2025. The Bench concluded by stating, “We clarify that this falls within the Union’s policy domain, and there is no reason to prevent the government from proceeding accordingly.”

Speaking on behalf of Vi, senior counsel Mukul Rohatgi expressed pleasure with the government’s strategy.

“Considering the current state of the case, the government has infused substantial equity into the company, and further, that the issue involved is likely to have a direct bearing on the interests of 20 crore customers, we see no issue in the Union reconsidering the issue and taking an appropriate decision,” the court stated, noting the government’s equity infusion and the potential impact on millions of users.

The Bench emphasized that its ruling was limited to the case’s special facts, including the central government’s ownership share in the business and its declared intention to safeguard the interests of consumers. A thorough order is anticipated.

Vi said it will cooperate with the government to remedy the AGR concerns and called the judgment that permitted the government to address the company’s complaints a “positive development.”

“This is a catalyst for our Honorable Prime Minister’s Digital India vision and goal,” the business stated in a statement.

Vi’s stock had the largest intraday increase since October 7 as it rose 9.3% during the day to a 52-week high of ₹10.52 per share. Later, the stock reduced its gains and ended the day up 4.16 percent at ₹10.02 on the NSE. On Monday, the Nifty 50 increased by 0.66 percent.

Legal and industry experts described the recent court ruling as a major turning point for both Vodafone Idea (Vi) and India’s telecom sector, noting that it gives the government more room to manage financial distress in the industry while preserving regulatory stability and market confidence.

“For Vi, this opens a crucial window to negotiate relief — whether through recalibrated dues or extended payment timelines — though it doesn’t amount to an automatic waiver,” said Smita Paliwal, Partner at King Stubb & Kasiva, Advocates and Attorneys. “The court’s focus on bringing ‘finality’ ensures that past liabilities can’t be endlessly reopened, creating much-needed regulatory certainty.”

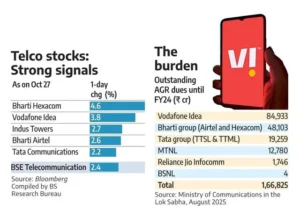

Paliwal further explained that other telecom operators may now seek discussions with the Department of Telecommunications (DoT) for similar relief, but any concessions will depend on each company’s circumstances and the government’s policy direction. Rival Bharti Airtel, for instance, had earlier requested that over ₹40,000 crore of its AGR dues be converted into equity. Both Vi and Airtel are among the telecom firms with significant AGR-related dues to the government.

“The court’s acknowledgment of the government’s policy-making role paves the way for a resolution without drawn-out litigation,” added Ashish Bhan, Partner at Trilegal. “This reduces regulatory uncertainty, offers clarity to stakeholders, and supports long-term sectoral stability. It’s a very constructive step for India’s telecom industry.”

The Case at a Glance

The Supreme Court’s decision came after Vi filed a plea in September, seeking a comprehensive reassessment of its Adjusted Gross Revenue (AGR) dues up to 2016–17. The company also challenged additional DoT demands for years already settled by the Court’s 2020 judgment, and requested a waiver of interest and penalties, arguing that the principal amount had not yet been finalized — making penalties unjustified.

Back in 2020, the Court had upheld DoT’s AGR calculations and fixed Vi’s dues at ₹58,254 crore, ruling that no further recalculation would be permitted. However, the total liability has since grown to ₹83,400 crore. According to Vi’s latest petition, DoT recently issued an additional demand of ₹9,450 crore, including ₹5,606 crore for 2016–17 alone.

Vi is expected to begin annual payments of ₹18,000 crore starting March 2026. The company’s former CEO, Akshaya Moondra, stated in August that resolving the AGR issue was vital for securing bank funding. Vi, which raised ₹18,000 crore through a follow-on public offer (FPO) in 2024, has also been pursuing new capital from non-banking financial institutions and has laid out a ₹50,000–55,000 crore capital expenditure plan over the next 3–5 years.

Courtroom Developments

During the hearings, the Court questioned whether it could revisit the AGR issue, given that a similar plea had already been dismissed. Solicitor General Tushar Mehta argued that the circumstances had evolved, while Senior Advocate Mukul Rohatgi, appearing for Vi, said the new petition was based on distinct facts.

In May 2025, a Bench comprising Justices J.B. Pardiwala and R. Mahadevan had dismissed similar petitions from Vi and other telecom operators seeking waivers on interest, penalties, and interest-on-penalty components. At that time, Chief Justice Gavai had stressed the importance of closure, saying, “There has to be some finality to the proceedings.”

Explaining the crux of the dispute, Rohatgi said:

“The mobile company pays a licence fee to the government, calculated on gross revenue. The question was — if Vi owns a hotel, should its hotel revenue be included in telecom revenue? The answer is clearly no. But DoT insisted on adding it.”

Summary

The Supreme Court’s latest stance signals a measured shift — reinforcing regulatory finality while allowing room for negotiation under the government’s policy framework. For the struggling telecom operator Vi, the decision offers a temporary lifeline, potentially enabling relief talks and financial restructuring, while the broader industry stands to gain from renewed policy clarity and stability.