MSMEs for Micro, Small and Medium Enterprise bear a significant impact on the GDP of India. They play a critical role for GDP, create millions job opportunities, and are important for guiding the development of regional imbalance. But adapting a new business is not without a hitch on how to run an MSME. The primary resources that are sometimes treated as barriers by small businesses are credit, markets, and rights.

What is udyam registration certificate? Explained

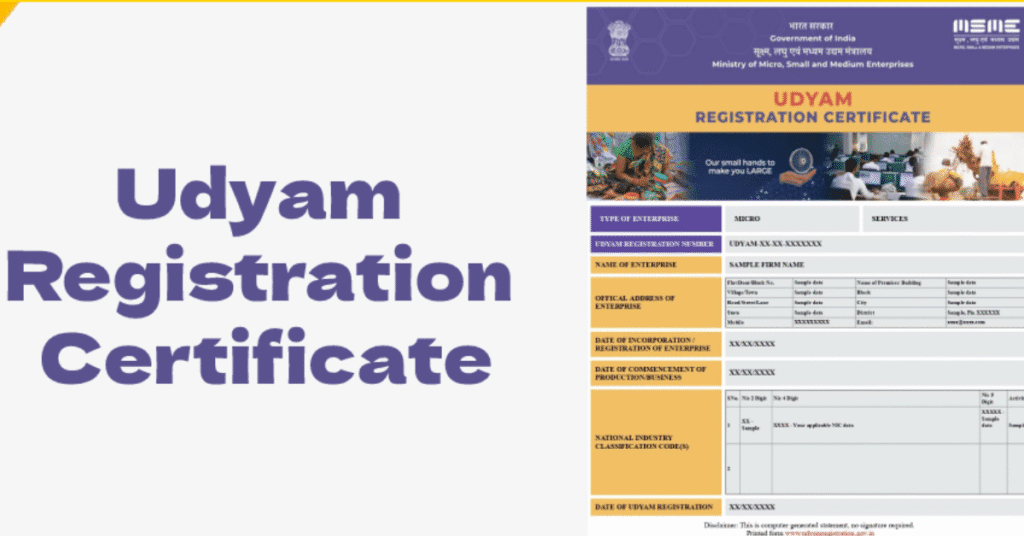

To overcome these problems, the Government of India has designed the Udyam Registration Certificate. This certificate is far more than just paper; it is an acknowledgement of your business and a ticket to government support programs, subsidies, and legal guard. In this guide every aspect regarding the Udyam Registration Certificate will be explained in detail so that you understand why it is needed? And how to get it?

What Is Udyam Registration Certificate?

The Udyam Registration Certificate is an identification number offer by the Ministry of Micro, Small, and Medium Enterprises (MSME) for business organizations that fall under the MSME grouping. It is provided when a business wants to register on the official Udyam Registration Portal.

Created in July 2020 this certificate succeeded the Udyog Aadhaar Memorandum (UAM) system. Due to this, it brings changes on the registration that makes it more discrete and without touching the physical interfaces. It has an indefinite validity to make sure that the msmes are able to enjoy one or the other government empowered scheme at any given time without the stress of renewal.

Key Features of Udyam Registration Certificate

The Udyam Registration Certificate stands out due to its streamlined features:

- Paperless and Digital:

All the registration processes are online and do not require the submission of physical prints.

- No Renewal Required:

The Udyam Certificate is also unique in the sense that its validity is for the lifetime of the holder.

- Integration with Other Platforms:

The Udyam Registration portal is already linked with GST portal and PAN servers to automatically validate the information provided by the businesses.

- Single Registration for Multiple Activities:

In case an MSME is involved in various affairs, it helps that only one online registration process is necessary.

- Universal Recognition:

The certificate is implemented all over the India, so the MSMEs can avail the state as well as the central government benefits.

Why Is the Udyam Registration Certificate Important?

- Unlocks Financial Benefits:

The certificate entitles the MSMEs for various government schemes that include; collateral-free loans, interest subsidies, and so on.

- Priority in Government Tenders:

Most government business and bidding opportunities are offered only to the Udyam-registered MSMEs, which make them stand out.

- Tax Benefits and Rebates:

Udyam Registration offers tax benefits and the entrepreneurial entity can avail different Income Tax Act benefits.

- Protection Against Delayed Payments:

The MSME Development Act makes sure that registered business entities receive their payments on time and the compensation is provided in case of delayed payments.

- Technology Support:

Government funded technology development programs and infrastructure support is available to the MSMEs.

Eligibility for Udyam Registration

To qualify for Udyam Registration, businesses must meet specific investment and turnover criteria.

MSME Classification:

| Category | Investment in Plant & Machinery | Annual Turnover |

| Micro | Up to ₹1 crore | Up to ₹5 crore |

| Small | Up to ₹10 crore | Up to ₹50 crore |

| Medium | Up to ₹50 crore | Up to ₹250 crore |

Businesses exceeding these limits are no longer classified as MSMEs.

Eligible Entities:

- Proprietorships

- Partnerships

- Hindu Undivided Families (HUFs)

- Private Limited Companies

- Limited Liability Partnerships (LLPs)

- Co-operatives and Societies

Documents Required for Udyam Registration

The Udyam Registration process is straightforward, but it requires some essential documents:

- Aadhaar Card: Mandatory for the business owner or authorized signatory.

- PAN Card: Necessary for tax compliance and verification.

- Bank Account Details: For financial transactions.

- GSTIN: Required if the business is GST-registered.

- Basic Business Details: Including name, location, commencement date, and type of activity.

How to Register for an Udyam Registration Certificate

The registration process for Udyam is simple, user-friendly, and entirely online. Here’s a step-by-step guide:

Step 1: Visit the Official Portal

Access the Udyam Registration Portal.

Step 2: Enter Aadhaar Details

Provide your Aadhaar number and verify it via OTP sent to your registered mobile number.

Step 3: Fill in Business Information

Enter details such as:

- Business name

- Type of organization (proprietorship, partnership, etc.)

- Address and location

Step 4: Provide Financial Information

Submit data related to:

- Investment in plant and machinery

- Annual turnover

Step 5: Validate PAN and GST Details

If applicable, your PAN and GSTIN will be auto-verified through integrated databases.

Step 6: Submit Application

After verifying the information, submit the form. Once processed, your Udyam Registration Certificate will be generated digitally.

Benefits of Udyam Registration Certificate

The Udyam Registration Certificate offers a plethora of benefits to MSMEs, including:

1. Financial Support

- Eligibility for collateral-free loans under the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE)

- Access to subsidies on interest rates.

2. Ease in Tax Compliance

- Reduction in income tax liability.

- Exemptions from direct taxes in certain cases.

3. Market Accessibility

- Preference in public procurement policies.

- Assistance in participating in e-marketplaces.

4. Infrastructure Development

- Access to industrial promotion subsidies.

- Support for setting up testing facilities and incubators.

5. Legal Protection

- Enhanced protection under the MSME Act.

- Faster dispute resolution for delayed payments.

Challenges Faced During Udyam Registration

While the process is simple, some businesses face hurdles, such as:

1. Incorrect Details

Mistakes in Aadhaar or PAN information can lead to rejection.

2. Lack of Awareness

Many businesses are unaware of the benefits of Udyam Registration.

3. Technical Issues

Glitches in the portal or delays in OTP verification can cause inconvenience.

4. Non-GST Compliance

Businesses not registered under GST may face restrictions during the process.

How to Update or Modify Udyam Registration?

If you need to make changes to your Udyam Certificate, follow these steps:

- Log into the Udyam Portal.

- Select the Update Option.

- Edit the Required Fields.

- Submit the Form for Review.

Frequently Asked Questions (FAQs)

1. Is Udyam Registration mandatory for MSMEs?

Yes, Udyam Registration is essential to avail of benefits under the MSME Development Act.

2. Can a business with multiple branches register separately?

No, a single Udyam Registration covers all branches.

3. Is there any fee for Udyam Registration?

No, the registration process is completely free.

4. What happens if my business exceeds the MSME limits?

Your classification will automatically update based on turnover and investment figures.

5. Can traders register for Udyam?

No, Udyam Registration is primarily for manufacturing and service-based businesses.

Conclusion

The Udyam Registration Certificate is a vital tool for MSMEs, empowering them to access financial support, government schemes, and market opportunities. It simplifies business operations, enhances credibility, and provides a framework for legal protection.

For MSMEs aiming to scale their operations, this certificate is a must-have. If you haven’t registered yet, take the leap today and unlock the numerous opportunities the Udyam Registration Certificate offers.