Written By: Avik Ghosh, Manager, Reserve Bank of India

The Economic Survey 2018-19: a guided roadmap to policy certainty

“The writer is an explorer. Every step is an advance into a new land”, once quoted by an idealist turned transcendentalist John Waldo Emerson, carries a feeling of importance of self-expression of an author with special emphasis on repetitive research to create something worth reading. Literature, having multi-layered medium of deliberations, teaches us to be cautious and mindful while creating a piece for readers.

Can economics as a subject and economic-essayists be so appealing in terms of articulation? The orthodox answer is ‘No’. But the magnificence assertion of core financial matters and economic jargons with simplicity, artistic expression, and well-researched examples got a new dimension with the publication of Economic Survey 2018-19.

It was not only an extraordinary display of deep-rooted data analysis but also a consolidation of prevailing and foreseeable economic issues that the readers can unriddle at ease while reading between the lines.

CEA Krishnamurthy V. Subramanian, in his maiden effort to showcase the consolidated health of Indian economy, had not only focussed on the key driving forces and indicators but he ensured the inclusion of much sought after socio-economic aspects starting from the consideration of behavioral economics and MSME sector to the special mention of redesigning minimum wage and implication of technology in welfare schemes.

His dissertation on ‘policy uncertainty’ and its effect on investment needs special mention due to its applicability in the present scenario where India is targeting a sustainable 8% real growth rate and planning to become a 5 trillion dollar economy by 2024-25. Taking a cue from the perennial importance of policy stability in the investment environment and subsequently on savings, employment and growth, it is ascertained that policy uncertainty may hurt the economic sentiment to a great extent.

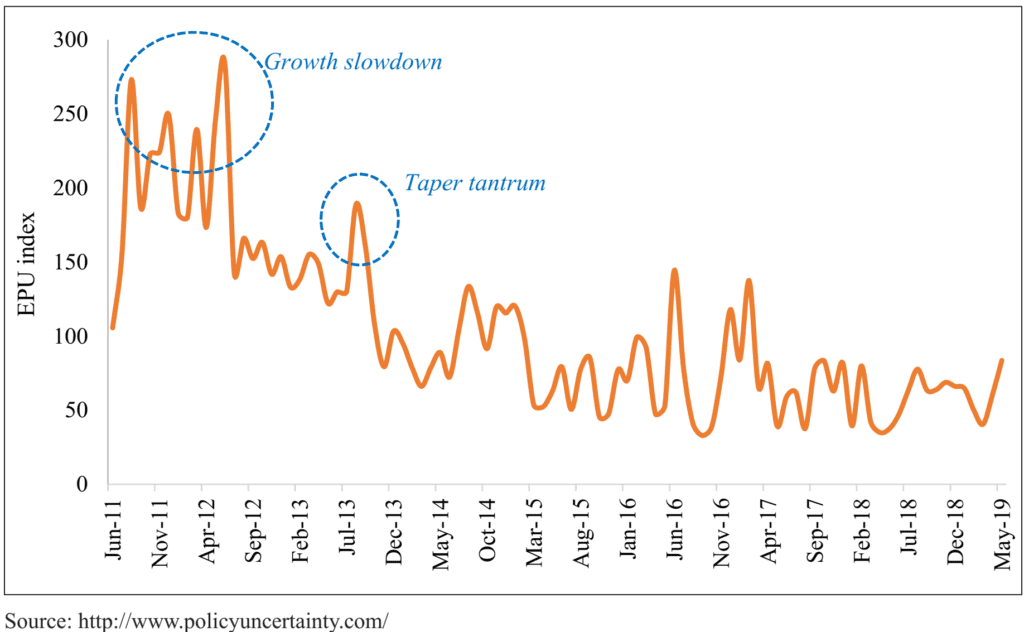

Chapter 6 of the Economic Survey elaborates on the cause and effects of policy uncertainty in a developing economy where the quantum of private investment matters immensely. As investment is considered to be irreversible and policy uncertainty contributes to systematic risk, the certainty of economic policy is a must. Data available for the last eight years depict the increased certainty in India over the period barring a few incidents with global impact.

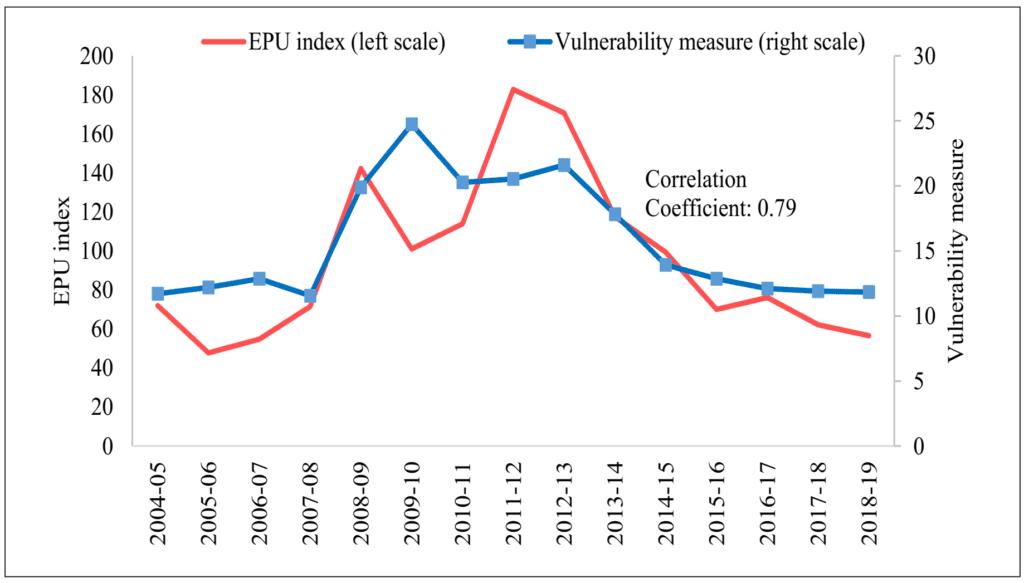

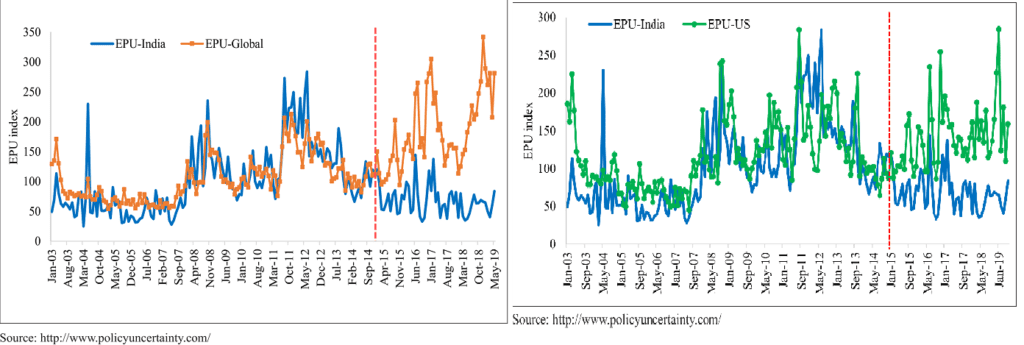

The strong correlation between Economic Policy Uncertainty (EPU) index and Vulnerability Index (sum of fiscal deficit, current account deficit and inflation rate) also highlights the importance of policy stability for a gross improvement of twin deficits. The survey also talks about the dependence of movement of policy uncertainty in India with other impactful countries till mid-2015 and slow

decoupling from the global trend since then. EPU is having positive correlation with exchange rate volatility, inflation volatility, WPI inflation and repo rate whereas it is negatively correlated with FDI inflow, FII quantum, gross capital formation growth and future expectation index.

This signifies the positive impact of policy stability in the economy. Developing expectation in the economy requires sustenance of a few parameters that in turn strengthen policy stability. Predictability for an economy helps investors to assess the return potential of the invested money and prod them to be ‘long’ in the country with low EPU. If we club this idea with a behavioral trend of investors, the ‘nudge’ factor works out to be the stability and non-volatility of the economy.

Once said earlier that India, with its macroeconomic prudence and policy measures, had overcome global financial shocks to a noticeable extent and the consistency in EPU index since 2015 exemplifies it. The recent trend in gross capital formation asserts an upward tendency from a dip in the past whereas the investment quantum with respect to GDP doesn’t exude an easy going picture as it got reduced from 37% to a mere 27% in a decade. To have a sustainable growth of 8% per year overcoming the expected inflation, it is mandatory to have some well defined policy measures in place to remove uncertainty.

As advised in the economic survey 2018-19, we need to have stricter policy norms in place backed by easier implementation roadmap. Additionally, we need to provide policy leeway for the investors to get invested. Thirdly, private investment should be encouraged by slowly curtailing standstill, irrelevant policies and by accelerating the policies with present relevance.

With a combination of these measures, the predictability in the economy improves which gradually directs economy on to a sustainable growth path. This is only feasible and implementable, as imbued with data driven guidelines in the economic survey, with the measurement, maintenance and internal targetting of the much-relevant EPU index ensuring “what gets measured, gets acted upon”.

Views expressed in the article are personal and not of RBI.