Padma Sai Finance: Simplifying the Automobile Loan Financing Process with Their Distinctive and Comprehensive Service Portfolio

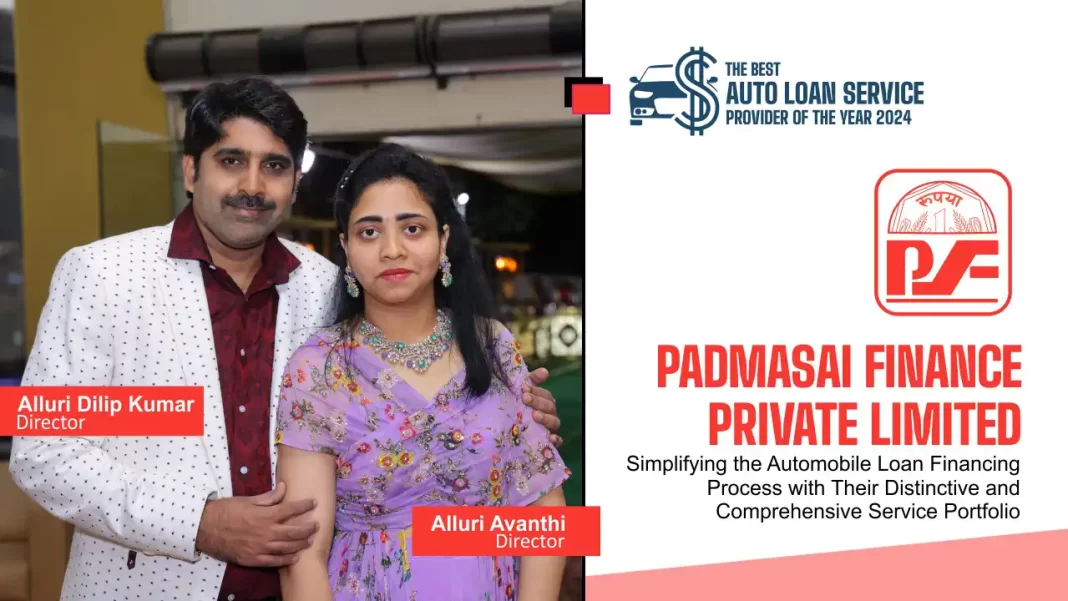

The Best Auto Loan Service Provider of the year 2024

Padma Sai Finance Pvt. Ltd., a new-age, tech-enabled intermediary service provider for NBFCs and financial institutions, has emerged as a ‘key player’ in the financing space.

Born from the vision of Mr Alluri Padmanabha Prasad Rao, Padma Sai Finance has become a transformative force in the realm of portfolio management services, particularly in the domain of automobile loan financing.

Incorporated in 1996, Padma Sai Finance has evolved from providing direct auto loans to performing as a crucial intermediary service provider for NBFCs and other lenders that finance auto loans. This transition occurred in 2018, signifying a major change in the company’s operations and focus.

Padma Sai Finance offers a comprehensive suite of services catering to diverse needs; one of its key offerings is auto loan intermediary services. Working as a facilitator between borrowers looking for auto finance and lenders offering such loans, Padma Sai Finance streamlines the loan application procedure.

Padma Sai Finance provides NBFCs with the all-around assistance they need to manage their loan portfolios effectively and reduce the risks involved in finding customers, doing fieldwork, evaluating credit, collecting documents, recovering overdue payments, repossession, and selling repossessed automobiles.

With a solid presence in 250 locations across Telangana, Andhra Pradesh, and Karnataka, the company caters to a diverse customer base. This extensive network underscores Padma Sai Finance’s commitment to connecting with clients from a variety of backgrounds and locations, making sure that their services are available to a wide range of users.

The Exclusive Mission, Vision, and Values

Padma Sai Finance is actively working on its mission to constantly strive to improve the quality of its services and expand its distribution network across India.

Padma Sai Finance is envisioned to be one of India’s leading financiers by providing quick and customized financial products and services that cater to the needs of the local community.

The company is guided by a set of core values that shape its culture, operations, and relationships with stakeholders. These values include integrity, customer centricity, excellence, innovation, collaboration, and social responsibility.

Navigating Setbacks

In the corporate world, acknowledging that obstacles are an inherent part of the journey is crucial. Padma Sai Finance needs to overcome various obstacles to achieve success in its endeavours, including those related to risk management, regulatory compliance, market competitiveness, client trust, and technology improvements. In the dynamic financial services industry, Padma Sai Finance could successfully navigate challenges and position itself for long-term growth and profitability by investing in compliance, risk management, innovation, and customer-centricity.

The USPs of Padma Sai Finance

One of the primary factors that distinguishes Padma Sai Finance is its unwavering focus on customer satisfaction. The company prioritizes the needs and interests of its customers, ensuring that their experience with Padma Sai Finance is smooth, transparent, and rewarding.

It boasts an extensive network spanning 250 locations that enables it to serve a wide range of customers, including those who live in rural, semi-rural, urban, and semi-urban populations. With over two decades of experience in this domain, the company has developed deep expertise and insights into managing loan portfolios efficiently and effectively.

The Latest Tech Innovations

In the auto financing industry, several important new technologies are being introduced to enhance efficiency, improve customer experience, and mitigate risk.

- Digital platforms and mobile apps are revolutionizing the way customers interact with auto financing companies.

- Blockchain technology is gaining traction in the auto financing industry for its potential to enhance security, transparency, and efficiency in transactions.

- Big data analytics tools are being leveraged to analyze vast amounts of customer data, market trends, and risk factors to inform lending decisions.

- CRM systems are becoming more and more crucial for auto financing organizations to track leads, handle client interactions, and cultivate relationships throughout the loan lifecycle.

Rewards and Recognitions Earned by Padma Sai Finance

Padma Sai Finance has achieved numerous awards and milestones. Some of their proudest moments were the recognition as the 2nd Best Performer in Bajaj Finance Limited in 2019 and being ranked as the 1st Best Performer in Shriram in 2017. While there have been overwhelming experiences, the company takes immense pride in its commitment to customer satisfaction, serving over 90,000 happy customers in the last decade alone.

Dynamic Leadership

- Alluri Dilip Kumar, Director

- Mrs Alluri Avanthi, Director

- Mr Allenki Akhil, Chief Financial Officer

- Mrs Gangampalli Uma Rani, Sr. Manager – HR

Pearls of Wisdom

Advising the aspiring business leaders, Mr Alluri Dilip Kumar stated, “Focus on leveraging emerging technologies, market trends, and consumer preferences to differentiate their offerings and stay ahead of the competition. Embrace digital transformation, explore new business models, and continuously innovate to meet the evolving needs of customers.”