Tax Planning – What, Why and How?

Introduction

Ramesh, a software developer in Bengaluru, runs 17 LPA and lives a pretty decent life with his wife and kids. However, when tax season comes, he’s a bit tense as now he has to pay taxes according to tax brackets under the income tax act. As per the new income tax regime, Ramesh has to pay Rs. 2,57,400 to authorities. Though this might not be a significant amount for a few, when Ramesh has to pay a staggering 15% of his total income, it’s like a sting that will hurt you more.

That’s why tax planning is essential; if Ramesh had planned his finances over time, he wouldn’t have to shell out this much tax out of his pocket. One of the most significant advantages of tax planning is that the money can be invested. It is the most efficient approach to make wise investments while fully leveraging the resources made available by tax breaks.

What exactly is tax planning?

Tax planning is a type of financial planning that focuses on tax efficiency. It seeks to lower one’s tax liabilities while making the best use of tax exemptions, tax refunds, and rebates under the Income Tax Act. Tax planning includes creating financial and economic decisions to reduce your taxable income. It allows you to properly reap the profit by utilizing all beneficial provisions under income tax rules. It will enable people to plan their finances and taxes from the start of the fiscal year, rather than waiting until the last minute.

Tax preparation involves a range of factors as expenses are addressed by size, income timing, purchases, and planning. The chosen investments and various retirement plans should work in tandem with the tax filing status and deductions to achieve the best possible result.

What is the Object of Tax Planning?

The primary objectives of your tax planning should be the following:

- Reducing Total Taxable Income – The primary purpose of tax planning is to lower the taxable income by investing in various tax-saving schemes, thus lowering the total balance upon which the income tax will be levied.

- Improve Financial Status – By investing in multiple schemes, one would only invest when he can grow their wealth over the period. Thus by saving money via tax planning, they are investing that money to improve their financial stability over time.

Why Should You Plan Your Taxes?

There are several primary goals of tax planning: reducing the tax burden by saving the overall taxable income by organizing their financial products following income tax benefits. One of the most significant advantages of tax planning is that the saved money from taxes can be invested to give you profitable returns in the future. It is the most efficient approach to make wise investments while fully leveraging the resources made available by tax benefits. Investing your money aids in the country’s economic progress, which in turn only be beneficial for you. Thus, tax planning adds to the individual’s and the country’s financial stability.

How To Do Tax Planning In India

There are a lot of tax-saving options available, and those plethora of options come in handy with certain deductions that turn out to be helpful. The deductions are available from Sections 80C, 80D, 80TTB, to 80U to qualifying taxpayers. Under these tax laws, the deductions are subtracted from the total amount of tax owing. Now, when one plays within the giving bounds of tax laws it is an ethical act, whereas unethical tactics to avoid paying taxes is illegal and has its own repercussions.

How to Save Tax?

When someone says tax-saving, the first thought that pops into the mind is ‘skip paying tax’. But, that’s not our motive in this blog. But the intent is to invest in the most suitable tax-saving instruments that maximize your benefits.

Here are the ways which you can use to save your taxes:

There are comprehensive plans in the market that can lower your taxable income to save taxes. However, every individual has their requirements from their investments. The following holds a list of a few such investment opportunities which can be considered for your tax planning.

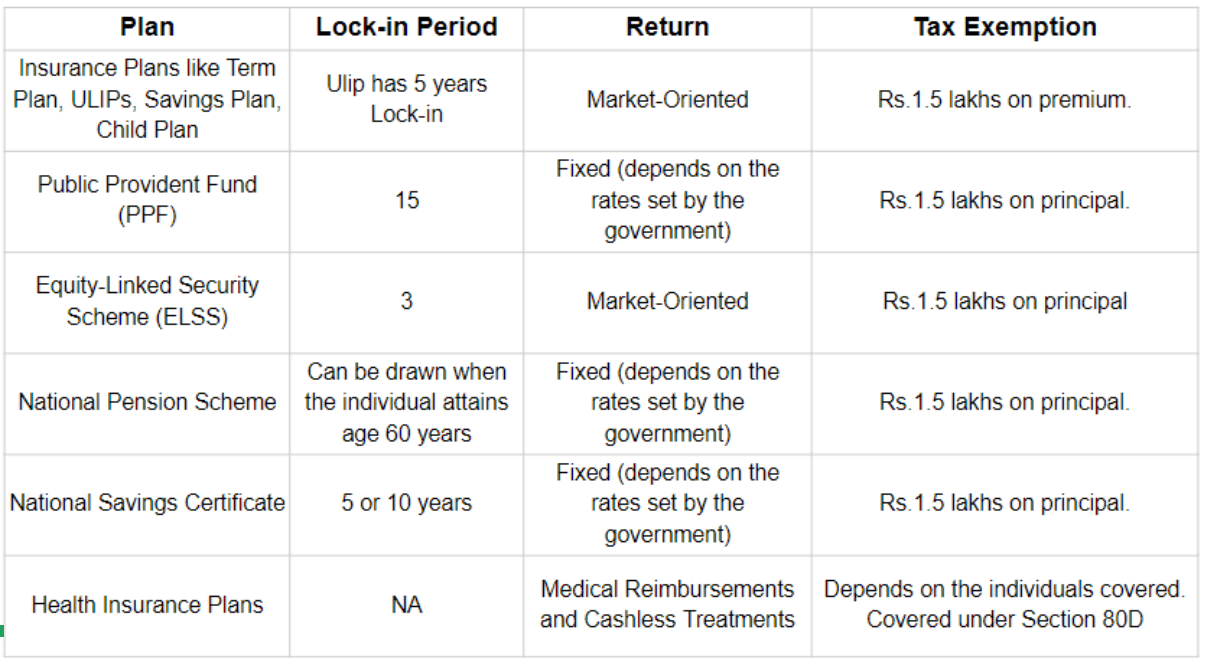

1.Life Insurance Plans: Life insurance policies have traditionally been a popular choice as tax-saving insurance plans. Though the purchase of a life insurance policy is dependent on the requirements, the primary reason it serves is tax exemption. Tax-saving life insurance products give you a tax break under Sections 80C and 10(10D) of the Income Tax Act of 1961. The maximum premium that can be paid to get a tax reduction is Rs.1.5 lakhs. The income on maturity is tax-free under Section 10(10D). Many different life insurance policies can attract your attention:

- Term Insurance

- ULIP Plans

- Savings Plan

- Child Plans

- Retirement Plans

- Group Insurance Plans

2.Public Provident Fund(PPF): Another popular method for saving taxes for Indian taxpayers is the Public Provident Fund. PPF accounts can be opened at a bank or a post office.

Individuals are drawn to PPF because it falls under tax exemptions, and Individuals who have a PPF account can claim a tax deduction for the amount they invest each year.

The deduction is allowable under Section 80C of the Income Tax Act of 1961. The maximum amount that can be deducted is Rs.1.5 lakh. The interest earned and the maturity funds from a PPF are likewise tax-free.

Public Provident Funds have a 15-year lock-in period and allow investors to withdraw the proceeds or continue for another five years.

3.ELSS Mutual Funds: ELSS Mutual Funds are another tax-advantaged investing option. Equity Linked Savings Schemes are popular due to their short lock-in period. Under Section 80 C of the Income Tax Act of 1961, you can invest in ELSS and obtain tax deductions from your total gross income of up to 1.5 lakhs.

Individuals seeking higher returns are more likely to invest in ELSS. These are equity-oriented mutual funds that carry higher risks and volatility. ELSS returns are tied to market-based performance.

Investing in ELSS is significantly more convenient because the funds can be paid in either a flat payment or through a monthly systematic investment plan (SIP).

4.National Pension Scheme: The National Pension Scheme (NPS) is a government-sponsored program that provides retirement security. Anyone who is an Indian citizen and is between the ages of 18 and 65 can join the National Pension Scheme. Still, they must have a Permanent Retirement Account Number assigned to them at enrollment.

The best part about this tax-saving tool is a voluntary scheme open to all Indian citizens. It means that anyone can invest in their NPS account and at any place. Individuals can claim a tax exemption of up to Rs. 50,000 under Section 80CCD when they invest in an NPS (1B). This benefit is in addition to the 1.5 lakh tax exemption claimed under Section 80C.

- National Savings Certificate: The National Savings Certificate is a fixed income investment scheme that allows participants to earn very high returns. These are low-risk investment vehicles that Provident Funds protect. As a responsible citizen, when you invest in National Savings Certificates, you can deduct up to Rs.1.5 lakhs under Section 80C of the Income Tax Act of 1961. National Savings Certificates offer investors total safety as well as guaranteed interest. National Savings Certificates have a guaranteed rate of return of 6.8%.

- Fixed Deposits(FDs): Fixed deposits are regarded as one of the most secure tax-saving investment vehicles. The instruments are less risky. The bank determines the interest rate on fixed deposits. Fixed deposits frequently have a 5-year minimum lock-in period. Senior citizens earn a better rate of return on their assets. Section 80C allows for a deduction for fixed-deposit investments.

5.Health Insurance Plans: India’s rising medical facility costs have forced people to get health insurance plans to recuperate fees incurred during hospitalization. It is one of the safest solutions because it provides tax benefits and the option to use medical facilities. Only if you are hospitalized for 24 hours will your health insurance pay for treating illness, disease, or accidental injuries.

Health insurance coverage for which you want to claim deductions can cover you, your spouse, or your children. The most significant tax advantage can be claimed under Section 80D of the Income Tax Act of 1961.

Conclusion:

Tax planning is essential for everybody who earns a living for themselves and their families. There are various options to help you with tax planning. You can select any of the above options based on the tax-saving investments tool’s needs. Remember to plan ahead of time for taxes to minimize last-minute headaches. Find the best strategy to save taxes and take advantage of the tax exemption limit.

Must Read:-

- Upcoming List of Top Indian Web Series of 2021

- Top 10 richest player of the world 2021

- Top 10 highest-paid Indian Athletes 2021

- Top 10 highest paid CEO in the World

- Top 10 richest person of India

- Top 10 Highest Paid CEOs of India

- List Of Most Followed Facebook Pages in 2021

- The Success Story of Jeff Bezos

- Success Story Of Elon Musk

- Top 10 Business Magazine In India

- Top 10 Business Newspaper In India

- Top 10 richest billionaires in the world 2021

- Upcoming English Web Series in 2021

- Top 10 Tourist Places in India, places to visit after lockdown