Shipping Vehicles to India: What You Need to Know

Shipping Vehicles to India: What You Need to Know

If...

Breaking Stereotypes: The Truth About Chinese Cars

Breaking Stereotypes: The Truth About Chinese Cars

Chinese cars have...

Custom Exhibition Stands: Why and How

Custom Exhibition Stands: Why and How

The opportunity to meet...

Unlocking the Secrets of the Digital Casino: An Immersive Journey of Discovery

Unlocking the Secrets of the Digital Casino: An Immersive...

Fresh stories

Today: Browse our editor's hand picked articles!

ITC Inaugurated Its First International Property In Colombo: Plans To Expand

ITC Inaugurated Its First International Property In Colombo: Plans...

RBI Barred Kotak From Issuing New Credit Cards

RBI Barred Kotak From Issuing New Credit Cards

By: Geetanjali

In...

Top 10 interior designers in the world

Top 10 interior designers in the world

A beautiful home-while...

How to rebuild credit after missed payments

By Jaya Pathak

How to rebuild credit after missed payments

The...

Should you opt for pre-approved credit cards?

Should you opt for pre-approved credit cards?

Nowadays, a number...

Follow This to Manage Your Credit Card Bills

Follow This to Manage Your Credit Card Bills

Credit cards...

Shipping Vehicles to India: What You Need to Know

Shipping Vehicles to India: What You Need to Know

If you're planning to move from the United States to India, one of the biggest challenges...

admin -

Guest Posts

Important Actions to Take in 2024 to Launch Your Own Forex Brokerage

Important Actions to Take in 2024 to Launch Your...

Guest Posts

Custodial Wallets vs Non-Custodial Wallets: What’s the Difference?

Custodial Wallets vs Non-Custodial Wallets: What’s the Difference?

Nowadays, security...

Guest Posts

Managing Risk in Forex Brokerage

Managing Risk in Forex Brokerage

You can't succeed in today's...

Popular

Guest Posts

Shipping Vehicles to India: What You Need to Know

Shipping Vehicles to India: What You Need to Know

If...

Guest Posts

Breaking Stereotypes: The Truth About Chinese Cars

Breaking Stereotypes: The Truth About Chinese Cars

Chinese cars have...

Guest Posts

Custom Exhibition Stands: Why and How

Custom Exhibition Stands: Why and How

The opportunity to meet...

Guest Posts

Unlocking the Secrets of the Digital Casino: An Immersive Journey of Discovery

Unlocking the Secrets of the Digital Casino: An Immersive...

News

ITC Inaugurated Its First International Property In Colombo: Plans To Expand

ITC Inaugurated Its First International Property In Colombo: Plans...

News

RBI Barred Kotak From Issuing New Credit Cards

RBI Barred Kotak From Issuing New Credit Cards

By: Geetanjali

In...

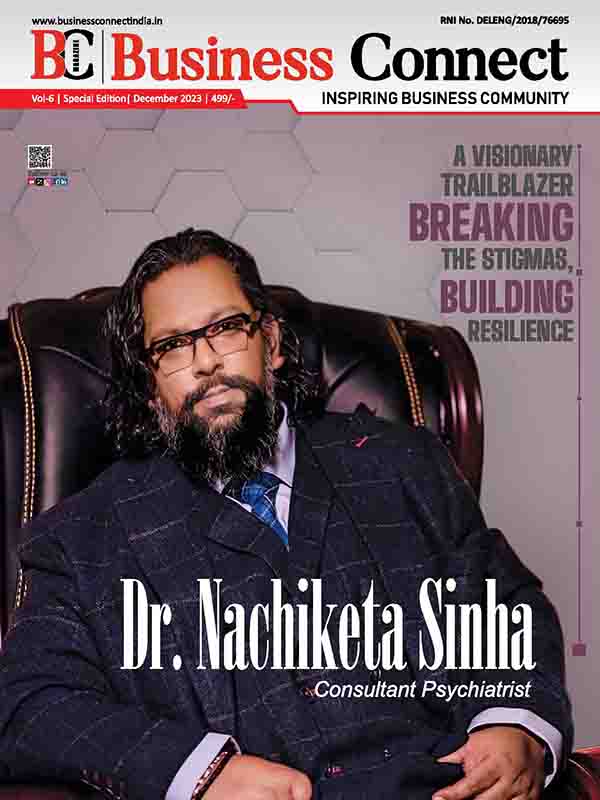

Company of The Year 2023

Transforming Spaces and Elevating Lives

FCI London

Transforming Spaces and Elevating Lives

The FCI London Journey...

JCasp Technologies Pvt. Ltd.

JCasp Technologies Pvt. Ltd.

Pioneering excellence in tech space…

Here comes...

CYBERGRID SOLUTIONS

CYBERGRID SOLUTIONS

Offering Impeccable Technology Solutions Since 2020

A research by...

Latest News

CelebrityLifestyle

Shipping Vehicles to India: What You Need to Know

Shipping Vehicles to India: What You Need to Know

If...

Breaking Stereotypes: The Truth About Chinese Cars

Breaking Stereotypes: The Truth About Chinese Cars

Chinese cars have...

Custom Exhibition Stands: Why and How

Custom Exhibition Stands: Why and How

The opportunity to meet...

Unlocking the Secrets of the Digital Casino: An Immersive Journey of Discovery

Unlocking the Secrets of the Digital Casino: An Immersive...

ITC Inaugurated Its First International Property In Colombo: Plans To Expand

ITC Inaugurated Its First International Property In Colombo: Plans...

RBI Barred Kotak From Issuing New Credit Cards

RBI Barred Kotak From Issuing New Credit Cards

By: Geetanjali

In...

Food & travel

Shipping Vehicles to India: What You Need to Know

Shipping Vehicles to India: What You Need to Know

If...

Breaking Stereotypes: The Truth About Chinese Cars

Breaking Stereotypes: The Truth About Chinese Cars

Chinese cars have...

Custom Exhibition Stands: Why and How

Custom Exhibition Stands: Why and How

The opportunity to meet...

Unlocking the Secrets of the Digital Casino: An Immersive Journey of Discovery

Unlocking the Secrets of the Digital Casino: An Immersive...

Exclusive content

Shipping Vehicles to India: What You Need to Know

Shipping Vehicles to India: What You Need to Know

If you're planning to move from the United States to India, one of the biggest challenges...

Guest Posts

Breaking Stereotypes: The Truth About Chinese Cars

Breaking Stereotypes: The Truth About Chinese Cars

Chinese cars have...

Guest Posts

Custom Exhibition Stands: Why and How

Custom Exhibition Stands: Why and How

The opportunity to meet...

Guest Posts

Unlocking the Secrets of the Digital Casino: An Immersive Journey of Discovery

Unlocking the Secrets of the Digital Casino: An Immersive...

News

ITC Inaugurated Its First International Property In Colombo: Plans To Expand

ITC Inaugurated Its First International Property In Colombo: Plans...

Recent postsLatest

Shipping Vehicles to India: What You Need to Know

Shipping Vehicles to India: What You Need to Know

If you're planning to move from the United States to India, one of the biggest challenges...

Breaking Stereotypes: The Truth About Chinese Cars

Breaking Stereotypes: The Truth About Chinese Cars

Chinese cars have...

Custom Exhibition Stands: Why and How

Custom Exhibition Stands: Why and How

The opportunity to meet...

Unlocking the Secrets of the Digital Casino: An Immersive Journey of Discovery

Unlocking the Secrets of the Digital Casino: An Immersive...

ITC Inaugurated Its First International Property In Colombo: Plans To Expand

ITC Inaugurated Its First International Property In Colombo: Plans...

RBI Barred Kotak From Issuing New Credit Cards

RBI Barred Kotak From Issuing New Credit Cards

By: Geetanjali

In...

Top 10 interior designers in the world

Top 10 interior designers in the world

A beautiful home-while...

How to rebuild credit after missed payments

By Jaya Pathak

How to rebuild credit after missed payments

The...

Should you opt for pre-approved credit cards?

Should you opt for pre-approved credit cards?

Nowadays, a number...

Follow This to Manage Your Credit Card Bills

Follow This to Manage Your Credit Card Bills

Credit cards...

Launchpad

Elon Musk Unveils Video of Tesla’s New Humanoid Robot—Showcases Dance Moves and Egg-Boiling Skills

Elon Musk Unveils Video of Tesla's New Humanoid Robot—Showcases...

Honor Launches Feature-Packed Honor 100 Series with 50-Megapixel Front Camera and Robust Battery

Honor Launches Feature-Packed Honor 100 Series with 50-Megapixel Front...

Tata Punch CNG Launches at ₹7.10 Lakh, Comes with a Sunroof

Tata Punch CNG Launches at Rs.7.10 Lakh, Comes with...

Realme C53: The Affordable 108MP Camera Phone with Unisoc T612 Chipset, Priced Under Rs 10,000!

Realme C53: The Affordable 108MP Camera Phone with Unisoc...

JioBook Laptop Launch Date Revealed via Amazon Teaser

JioBook Laptop Launch Date Revealed via Amazon Teaser

Written by...

Business Connect is a best business magazine whose name is derived from Business Community which connects entrepreneurs, executive officers and VCs.